south dakota property tax exemption

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Taxes in South Dakota are due and payable the first of January however the first half of property tax payments are accepted until April 30th without penalty.

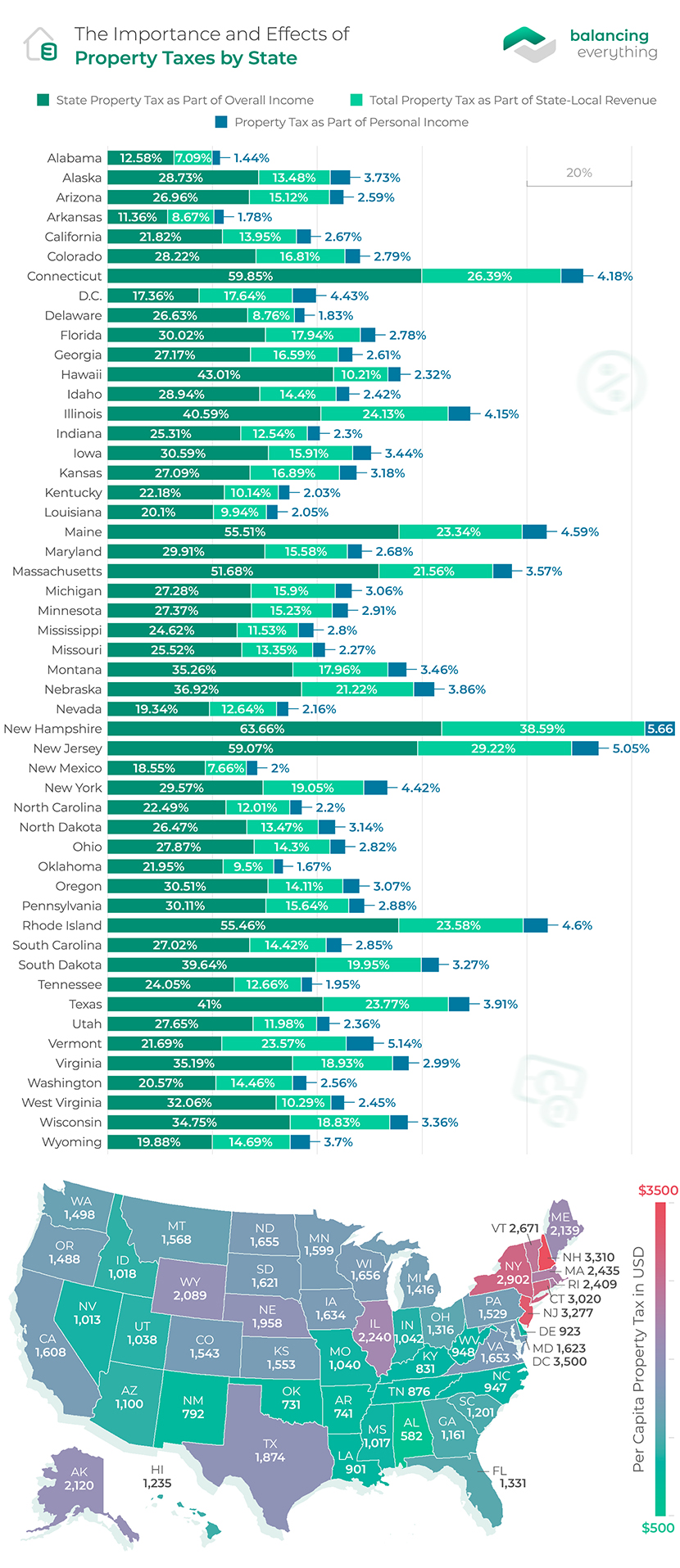

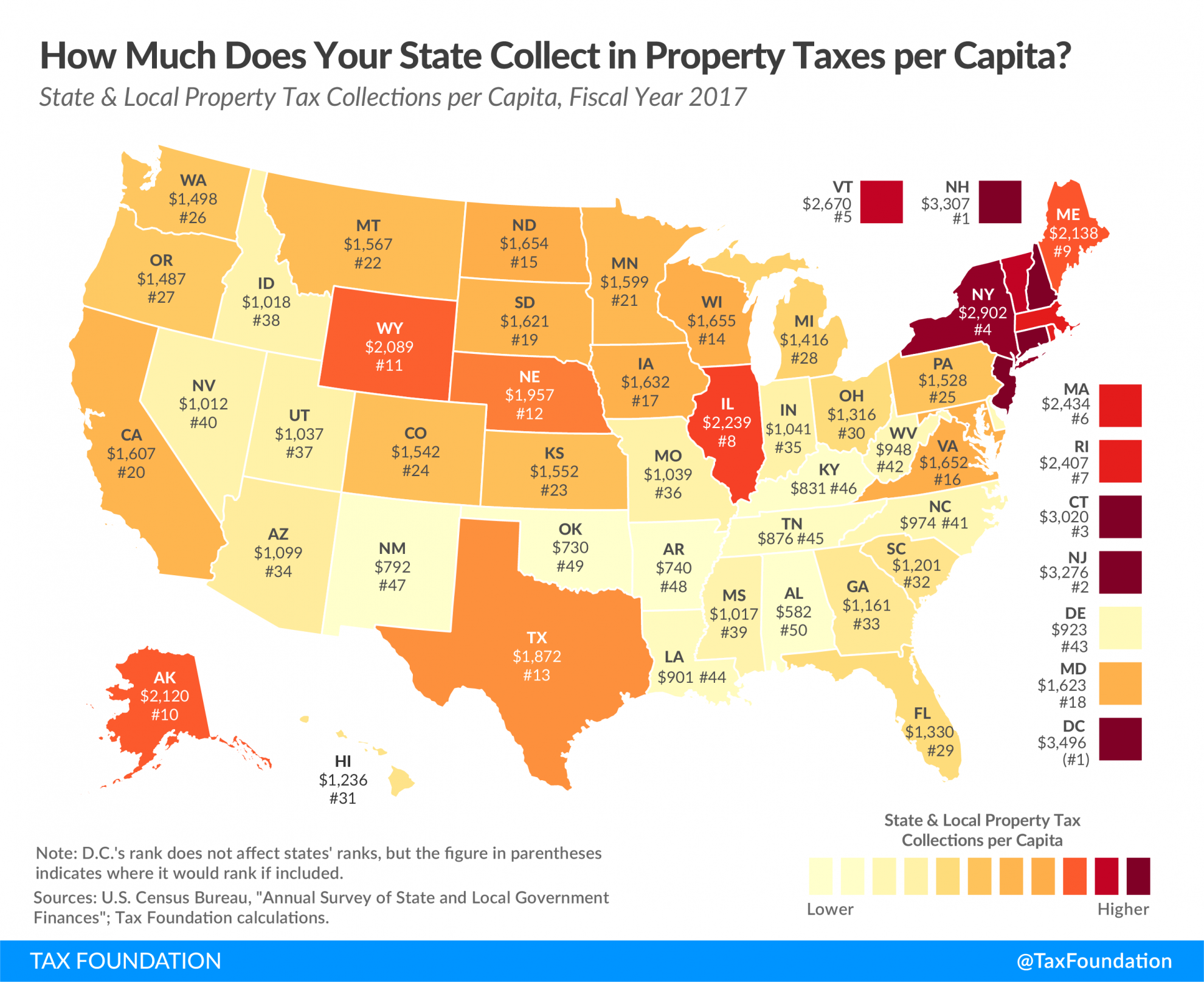

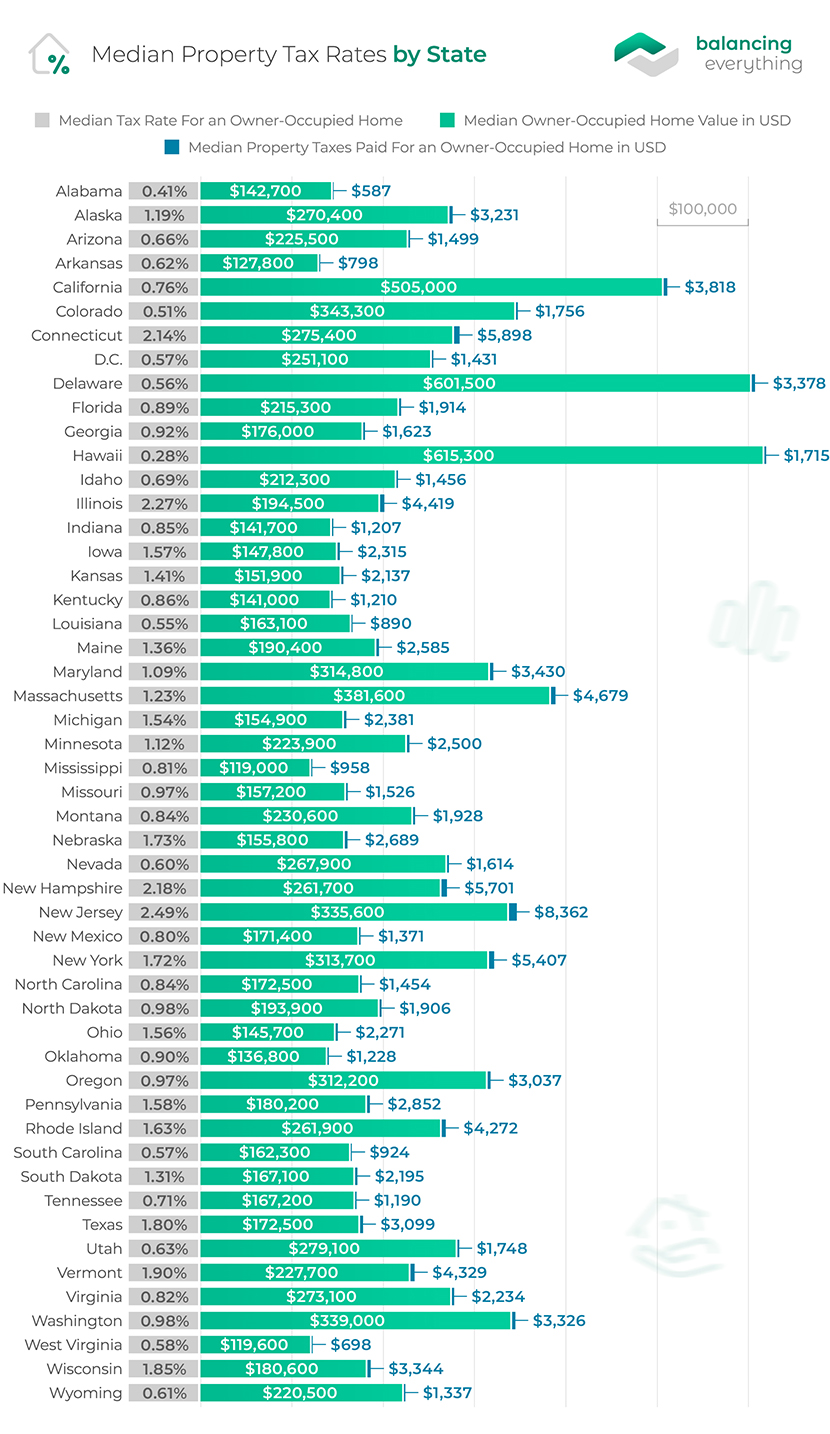

Property Tax Comparison By State For Cross State Businesses

Assessor Madison County Assessor 16 East 9th St Room 203 Anderson IN 46016 Phone.

. South Dakota Directors of Equalization knowledge base for property tax exemptions sales ratio and growth definitions. State lawmakers seeking to enact residential property tax relief have two broad options. 765 641-9401 Fax 765608-9707.

Across-the-board tax cuts for taxpayers at all income levels and targeted tax breaks. Seniors who are 65 or older receive a full exemption on the first 7500 of their propertys assessed value. Search Madison County property tax and assessment records by owner name property address parcel number or tax id.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. The second half of property tax payments will be accepted until October 31st without penalty. One reason property taxes in New Mexico are so low is that the state has capped the amount the taxable value of a property can increase in a year at 3.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. So youd think states with high property taxes would have low income tax rates. Likewise the states average effective property tax rate is 078.

California and Illinois have high income tax and high property tax burdens the CBPP says. Real Estate Tax Program. South Carolina collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Real estate tax notices are mailed to property owners in January. How to use sales tax exemption certificates in Arizona. Tennessee and New Hampshire only tax interest and dividend income not wages.

See County Resources Exempt Entities -. See Application Sales Ratio Portal. The median annual property tax paid by homeowners in New Mexico is 1403 about 1200 less than the US.

How to use sales tax exemption certificates in Maine. More than 40 states have chosen to achieve across-the-board tax relief by providing a homestead exemption. Notably South Carolina has the highest maximum marginal tax bracket in the United States.

Unlike the Federal Income Tax South Carolinas state income tax does not provide couples filing jointly with expanded income tax brackets. Applications must be submitted to the county assessors office at the county in which the property is located. Learn more in our Guide to South Dakotas Disabled Veteran Property Tax Exemption Program PDF.

Tax rates in Mississippi are determined by local tax authorities based on the amount of revenue they need to fill their budgets. You can learn more about how the South. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax.

Mississippi Property Tax Rates. Tax rates are expressed in millage rates. Application are available at the county courthouse or from the Property Tax Division.

Ebay Will Collect Sales Tax In 5 More States Sales Tax Marketing Communication States

New Ag Census Shows Disparities In Property Taxes By State

Relief Programs South Dakota Department Of Revenue

Property Tax Definition Learn About Property Taxes Taxedu

Property Taxes By State In 2022 A Complete Rundown

Disabled Veterans Property Tax Exemptions By State

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global